Yeah, the only ones that aren't now are the civil service ones.The sun god wrote: Thu Oct 13, 2022 8:09 amThat is NOT the case at all. All these funds are managed externally and ringfenced so of course they can go bust.robmatic wrote: Wed Oct 12, 2022 8:37 amI would be very surprised if any pension fund collapses - the employer has to collapse first for that to happen. The reporting of this issue has been woeful, and I suspect that it's not the actual pension funds that are at risk but other players in the market. The payments out to pension fund members are spread out over decades and the scheme valuations don't happen particularly quickly. Generally speaking, DB funds will be happy with the current climate and yields rising because it will have a positive effect come valuation time due to the benefits becoming much cheaper to provide.fishfoodie wrote: Tue Oct 11, 2022 9:12 pm

I don't think they can survive even a relatively small pension fund collapsing; but I have a horrible feeling that we aren't taking about small pension funds here, I think it's the biggies with the sword of Damocles hanging above their heads.

If a major pension goes under, we aren't just talking about losing a GE, or two; we're talking about the total destruction of the Conservative Party. It's hard to overstate how bad this could be.

Stop voting for fucking Tories

And are there two g’s in Bugger Off?

With DB pension funds the employer is liable if they are underfunded, regardless of who is managing the funds.The sun god wrote: Thu Oct 13, 2022 8:09 amThat is NOT the case at all. All these funds are managed externally and ringfenced so of course they can go bust.robmatic wrote: Wed Oct 12, 2022 8:37 amI would be very surprised if any pension fund collapses - the employer has to collapse first for that to happen. The reporting of this issue has been woeful, and I suspect that it's not the actual pension funds that are at risk but other players in the market. The payments out to pension fund members are spread out over decades and the scheme valuations don't happen particularly quickly. Generally speaking, DB funds will be happy with the current climate and yields rising because it will have a positive effect come valuation time due to the benefits becoming much cheaper to provide.fishfoodie wrote: Tue Oct 11, 2022 9:12 pm

I don't think they can survive even a relatively small pension fund collapsing; but I have a horrible feeling that we aren't taking about small pension funds here, I think it's the biggies with the sword of Damocles hanging above their heads.

If a major pension goes under, we aren't just talking about losing a GE, or two; we're talking about the total destruction of the Conservative Party. It's hard to overstate how bad this could be.

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

Yup.The sun god wrote: Thu Oct 13, 2022 8:09 amThat is NOT the case at all. All these funds are managed externally and ringfenced so of course they can go bust.robmatic wrote: Wed Oct 12, 2022 8:37 am I would be very surprised if any pension fund collapses - the employer has to collapse first for that to happen. The reporting of this issue has been woeful, and I suspect that it's not the actual pension funds that are at risk but other players in the market. The payments out to pension fund members are spread out over decades and the scheme valuations don't happen particularly quickly. Generally speaking, DB funds will be happy with the current climate and yields rising because it will have a positive effect come valuation time due to the benefits becoming much cheaper to provide.

a) I've already pointed out that there are already 1000+ schemes in the PPF and many more were on the precipice BEFORE this sh*t hit the fan. So if you are surprised and have any DB benefits lying around, I recommend you obtain what used to be an FRS17 valuation (superseded by 102 I think). I don't know of a single, significant sized DB scheme in the UK that is not underfunded. OTTOMH, that includes, USS, BAe, Dixons, BT, Shell, BA, Premier Foods, Thomas Cook............ would you like me to stop?

b) No, the employer does not have to collapse first for that to happen. I know where you are coming from and, in theory, there is a broad set of rules obligating employers to make good any shortfalls. However, as it became increasingly clear through the 90s that imposing these rules would bankrupt many employers, they were all watered down and then ignored. Because whilst employees might not want to concede to reduced pension promises, they are even less likely to want to become unemployed. If you want a great example of the shenanigans this all results in, take a look at Monarch Airlines and how the Mantegazzas walked away from the whole mess (part of this is in the fact that many of these companies are global and/or not UK dom and so the UK can't impose jack sh*t upon the parent).

c) Nice theory. However, it ignores the fact that if the profile of your liabilities (payments to retirees and transfers out) is on an trajectory that takes you into failure faster than assets can plug the gap (continuing contributions, member deaths and other scheme modifications designed to curtail the damage e.g. pushing out NRA), then you are f**ked. And that's where many schemes are. You are correct that scheme valuations don't happen quickly and the whole thing is a murky, dark art but that is irrelevant. The reason some DB schemes are not happy with the current climate is because (again, I've commented on in this thread) is they have been running LDI strategies and the current conditions mean these long term strategies have to get unwound, at a huge loss, NOW. All bets off sir.

- fishfoodie

- Posts: 8729

- Joined: Mon Jun 29, 2020 8:25 pm

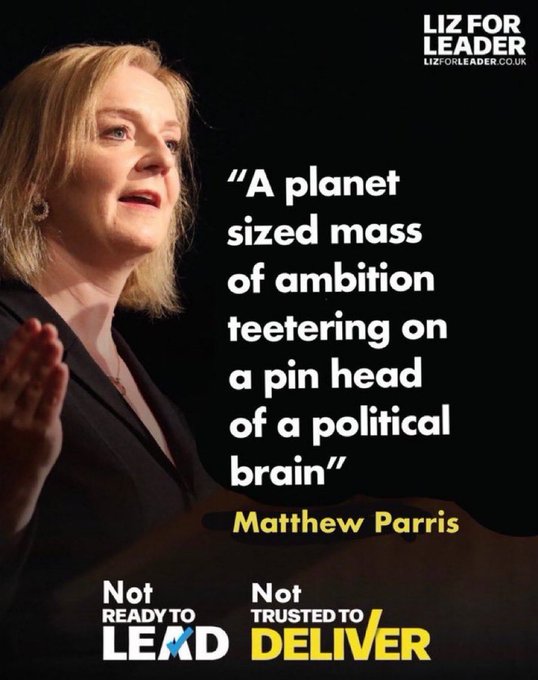

That's some selection of quotes, about a PM who is still in her, "Honeymoon"

I think they'll give her till the announcement on the 31st, to make the numbers add up, & square it with the OBR, & if she can't, she's gone !!

The MPs all know they're fucked in the next GE, so her threatening them with losing the whip, or deselection is no threat at all. They'll vote down her Budget, & bring down the Government.

We all know she can't square the numbers, so there'll be a new PM spending Christmas in No10

Not a sqeak out of Coffey on these issues. Too busy running round appeasing the tobacco and sugar industries!!!

Staff shortages!

Staff and blood shortages!

Staff shortages!

https://www.bbc.co.uk/news/health-63219147The push to tackle the hospital backlog is being undermined by the struggle to get services back to full strength.

Staff and blood shortages!

https://www.bbc.co.uk/news/health-63229980Blood supplies have fallen to a critically low level in England, meaning hospitals may have to postpone some non-urgent operations.

An amber alert is now in force to ensure blood reaches patients most in need.

A lack of staff to care for people giving blood was partly to blame, NHS Blood and Transplant (NHSBT) said.

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

Kinda. The Public Sector ones are split between funded and those which are Ponzi Schemes i.e. current contributions simply go to pay existing claimants. The tax payer continues to plug any gaps. So, the PS one's can't go bust in theory, because the tax payer is propping them up. But the hole is over £2 trillion now which is double what it was a decade or so ago. How long can this continue before a Government has to impose a massive overhaul (rather than tinkering at the edges)?Biffer wrote: Thu Oct 13, 2022 8:40 amYeah, the only ones that aren't now are the civil service ones.The sun god wrote: Thu Oct 13, 2022 8:09 amThat is NOT the case at all. All these funds are managed externally and ringfenced so of course they can go bust.robmatic wrote: Wed Oct 12, 2022 8:37 am

I would be very surprised if any pension fund collapses - the employer has to collapse first for that to happen. The reporting of this issue has been woeful, and I suspect that it's not the actual pension funds that are at risk but other players in the market. The payments out to pension fund members are spread out over decades and the scheme valuations don't happen particularly quickly. Generally speaking, DB funds will be happy with the current climate and yields rising because it will have a positive effect come valuation time due to the benefits becoming much cheaper to provide.

- The sun god

- Posts: 176

- Joined: Wed Jul 01, 2020 6:40 am

- Location: It's nice in Nice.

Yup......Torquemada 1420 wrote: Thu Oct 13, 2022 9:10 amYup.The sun god wrote: Thu Oct 13, 2022 8:09 amThat is NOT the case at all. All these funds are managed externally and ringfenced so of course they can go bust.robmatic wrote: Wed Oct 12, 2022 8:37 am I would be very surprised if any pension fund collapses - the employer has to collapse first for that to happen. The reporting of this issue has been woeful, and I suspect that it's not the actual pension funds that are at risk but other players in the market. The payments out to pension fund members are spread out over decades and the scheme valuations don't happen particularly quickly. Generally speaking, DB funds will be happy with the current climate and yields rising because it will have a positive effect come valuation time due to the benefits becoming much cheaper to provide.

a) I've already pointed out that there are already 1000+ schemes in the PPF and many more were on the precipice BEFORE this sh*t hit the fan. So if you are surprised and have any DB benefits lying around, I recommend you obtain what used to be an FRS17 valuation (superseded by 102 I think). I don't know of a single, significant sized DB scheme in the UK that is not underfunded. OTTOMH, that includes, USS, BAe, Dixons, BT, Shell, BA, Premier Foods, Thomas Cook............ would you like me to stop?

b) No, the employer does not have to collapse first for that to happen. I know where you are coming from and, in theory, there is a broad set of rules obligating employers to make good any shortfalls. However, as it became increasingly clear through the 90s that imposing these rules would bankrupt many employers, they were all watered down and then ignored. Because whilst employees might not want to concede to reduced pension promises, they are even less likely to want to become unemployed. If you want a great example of the shenanigans this all results in, take a look at Monarch Airlines and how the Mantegazzas walked away from the whole mess (part of this is in the fact that many of these companies are global and/or not UK dom and so the UK can't impose jack sh*t upon the parent).

c) Nice theory. However, it ignores the fact that if the profile of your liabilities (payments to retirees and transfers out) is on an trajectory that takes you into failure faster than assets can plug the gap (continuing contributions, member deaths and other scheme modifications designed to curtail the damage e.g. pushing out NRA), then you are f**ked. And that's where many schemes are. You are correct that scheme valuations don't happen quickly and the whole thing is a murky, dark art but that is irrelevant. The reason some DB schemes are not happy with the current climate is because (again, I've commented on in this thread) is they have been running LDI strategies and the current conditions mean these long term strategies have to get unwound, at a huge loss, NOW. All bets off sir.

Some of the overhaul has already been done - now contributory, average salary not final salary, retirement age now in line with state pension instead of 60 - but as with everything pensions related, it takes decades to have an effect. And it's just impossible to take historical benefits away. Civil servants get paid less than they would in industry (substantially so in a lot of cases, we can't recruit mid career engineers for love nor money as we're about £15-20k short of market rates in some disciplines) and one of the reasons that's always pointed to for that is the pension. The only further 'overhaul' is to take that down to industry pension levels but that would then require massive pay rises (or if not, huge leavers from the CS to the extent that government wouldn't function*) which no government is going to take on. The can will continue to be kicked down the road.Torquemada 1420 wrote: Thu Oct 13, 2022 9:20 amKinda. The Public Sector ones are split between funded and those which are Ponzi Schemes i.e. current contributions simply go to pay existing claimants. The tax payer continues to plug any gaps. So, the PS one's can't go bust in theory, because the tax payer is propping them up. But the hole is over £2 trillion now which is double what it was a decade or so ago. How long can this continue before a Government has to impose a massive overhaul (rather than tinkering at the edges)?Biffer wrote: Thu Oct 13, 2022 8:40 amYeah, the only ones that aren't now are the civil service ones.The sun god wrote: Thu Oct 13, 2022 8:09 am

That is NOT the case at all. All these funds are managed externally and ringfenced so of course they can go bust.

So how exactly does anyone fix that?

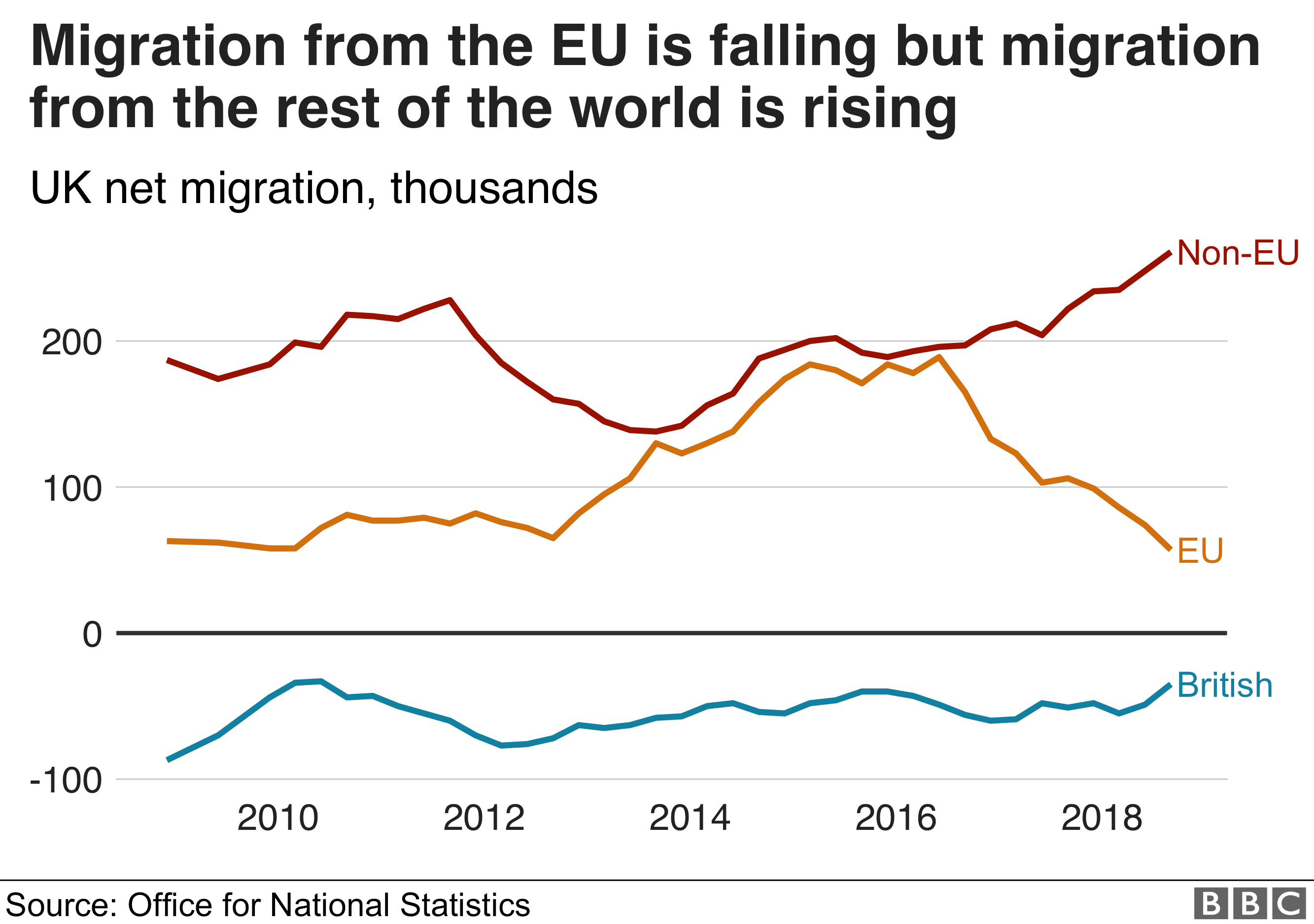

One of the major problems with all of this is the demographic timebomb - but we're shutting down immigration (or so we're led to believe, how accurate that is is debatable) so that's only going to get worse.

*And when I say wouldn't function I mean all the standard things done that people don't think about - benefits, taxes, justice, passports and drivers licenses, a huge long list that would just collapse.

Edit - in all honesty I've got it in the back of my head that I might just take the transfer value from my CS pension and run if that's an option a year or so before I retire. I'm a single man with no kids, so I can potentially get a better return without the assumption of the widow's pension costed in to the calculation (which it automatically is within the scheme). But the shit might have hit the fan before I get to that stage.

And are there two g’s in Bugger Off?

- Paddington Bear

- Posts: 6653

- Joined: Tue Jun 30, 2020 3:29 pm

- Location: Hertfordshire

Biffer wrote: Thu Oct 13, 2022 10:26 amSome of the overhaul has already been done - now contributory, average salary not final salary, retirement age now in line with state pension instead of 60 - but as with everything pensions related, it takes decades to have an effect. And it's just impossible to take historical benefits away. Civil servants get paid less than they would in industry (substantially so in a lot of cases, we can't recruit mid career engineers for love nor money as we're about £15-20k short of market rates in some disciplines) and one of the reasons that's always pointed to for that is the pension. The only further 'overhaul' is to take that down to industry pension levels but that would then require massive pay rises (or if not, huge leavers from the CS to the extent that government wouldn't function*) which no government is going to take on. The can will continue to be kicked down the road.Torquemada 1420 wrote: Thu Oct 13, 2022 9:20 amKinda. The Public Sector ones are split between funded and those which are Ponzi Schemes i.e. current contributions simply go to pay existing claimants. The tax payer continues to plug any gaps. So, the PS one's can't go bust in theory, because the tax payer is propping them up. But the hole is over £2 trillion now which is double what it was a decade or so ago. How long can this continue before a Government has to impose a massive overhaul (rather than tinkering at the edges)?Biffer wrote: Thu Oct 13, 2022 8:40 am

Yeah, the only ones that aren't now are the civil service ones.

So how exactly does anyone fix that?

One of the major problems with all of this is the demographic timebomb - but we're shutting down immigration (or so we're led to believe, how accurate that is is debatable) so that's only going to get worse.

*And when I say wouldn't function I mean all the standard things done that people don't think about - benefits, taxes, justice, passports and drivers licenses, a huge long list that would just collapse.

Edit - in all honesty I've got it in the back of my head that I might just take the transfer value from my CS pension and run if that's an option a year or so before I retire. I'm a single man with no kids, so I can potentially get a better return without the assumption of the widow's pension costed in to the calculation (which it automatically is within the scheme). But the shit might have hit the fan before I get to that stage.

Yep there's no cut to immigration

Old men forget: yet all shall be forgot, But he'll remember with advantages, What feats he did that day

Yeah, and now they're taking the high paid jobs instead of the service / hospitality / etc lower paid jobs. So that policy is condemning young UK citizens to doing those low paid jobs. Whilst we let folk come from over the world to squeeze the profit out of us.Paddington Bear wrote: Thu Oct 13, 2022 10:30 amBiffer wrote: Thu Oct 13, 2022 10:26 amSome of the overhaul has already been done - now contributory, average salary not final salary, retirement age now in line with state pension instead of 60 - but as with everything pensions related, it takes decades to have an effect. And it's just impossible to take historical benefits away. Civil servants get paid less than they would in industry (substantially so in a lot of cases, we can't recruit mid career engineers for love nor money as we're about £15-20k short of market rates in some disciplines) and one of the reasons that's always pointed to for that is the pension. The only further 'overhaul' is to take that down to industry pension levels but that would then require massive pay rises (or if not, huge leavers from the CS to the extent that government wouldn't function*) which no government is going to take on. The can will continue to be kicked down the road.Torquemada 1420 wrote: Thu Oct 13, 2022 9:20 am

Kinda. The Public Sector ones are split between funded and those which are Ponzi Schemes i.e. current contributions simply go to pay existing claimants. The tax payer continues to plug any gaps. So, the PS one's can't go bust in theory, because the tax payer is propping them up. But the hole is over £2 trillion now which is double what it was a decade or so ago. How long can this continue before a Government has to impose a massive overhaul (rather than tinkering at the edges)?

So how exactly does anyone fix that?

One of the major problems with all of this is the demographic timebomb - but we're shutting down immigration (or so we're led to believe, how accurate that is is debatable) so that's only going to get worse.

*And when I say wouldn't function I mean all the standard things done that people don't think about - benefits, taxes, justice, passports and drivers licenses, a huge long list that would just collapse.

Edit - in all honesty I've got it in the back of my head that I might just take the transfer value from my CS pension and run if that's an option a year or so before I retire. I'm a single man with no kids, so I can potentially get a better return without the assumption of the widow's pension costed in to the calculation (which it automatically is within the scheme). But the shit might have hit the fan before I get to that stage.

Yep there's no cut to immigration

And are there two g’s in Bugger Off?

- Paddington Bear

- Posts: 6653

- Joined: Tue Jun 30, 2020 3:29 pm

- Location: Hertfordshire

Fwiw there's never been a huge issue getting Brits to do service/hospitality jobs, there's an issue getting Brits to work for below living wages that has been ameliorated by us as a society being happy for primarily Eastern Europeans to live in conditions that would be fairly described as squalour for our benefit. Of course these countries are now much wealthier than they were upon EU accession and so there's less incentive for them to do something that grim.Biffer wrote: Thu Oct 13, 2022 10:39 amYeah, and now they're taking the high paid jobs instead of the service / hospitality / etc lower paid jobs. So that policy is condemning young UK citizens to doing those low paid jobs. Whilst we let folk come from over the world to squeeze the profit out of us.Paddington Bear wrote: Thu Oct 13, 2022 10:30 amBiffer wrote: Thu Oct 13, 2022 10:26 am

Some of the overhaul has already been done - now contributory, average salary not final salary, retirement age now in line with state pension instead of 60 - but as with everything pensions related, it takes decades to have an effect. And it's just impossible to take historical benefits away. Civil servants get paid less than they would in industry (substantially so in a lot of cases, we can't recruit mid career engineers for love nor money as we're about £15-20k short of market rates in some disciplines) and one of the reasons that's always pointed to for that is the pension. The only further 'overhaul' is to take that down to industry pension levels but that would then require massive pay rises (or if not, huge leavers from the CS to the extent that government wouldn't function*) which no government is going to take on. The can will continue to be kicked down the road.

So how exactly does anyone fix that?

One of the major problems with all of this is the demographic timebomb - but we're shutting down immigration (or so we're led to believe, how accurate that is is debatable) so that's only going to get worse.

*And when I say wouldn't function I mean all the standard things done that people don't think about - benefits, taxes, justice, passports and drivers licenses, a huge long list that would just collapse.

Edit - in all honesty I've got it in the back of my head that I might just take the transfer value from my CS pension and run if that's an option a year or so before I retire. I'm a single man with no kids, so I can potentially get a better return without the assumption of the widow's pension costed in to the calculation (which it automatically is within the scheme). But the shit might have hit the fan before I get to that stage.

Yep there's no cut to immigration

Old men forget: yet all shall be forgot, But he'll remember with advantages, What feats he did that day

No argument from me, ties in to productivity, relative income distribution, Gini coefficient, investment in infrastructure, etc etc. We need to start a programme that's broadly equivalent to the German investment in the old East Germany to put the UK's economy right.Paddington Bear wrote: Thu Oct 13, 2022 10:55 amFwiw there's never been a huge issue getting Brits to do service/hospitality jobs, there's an issue getting Brits to work for below living wages that has been ameliorated by us as a society being happy for primarily Eastern Europeans to live in conditions that would be fairly described as squalour for our benefit. Of course these countries are now much wealthier than they were upon EU accession and so there's less incentive for them to do something that grim.Biffer wrote: Thu Oct 13, 2022 10:39 amYeah, and now they're taking the high paid jobs instead of the service / hospitality / etc lower paid jobs. So that policy is condemning young UK citizens to doing those low paid jobs. Whilst we let folk come from over the world to squeeze the profit out of us.

And are there two g’s in Bugger Off?

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

In all seriousness, it's worth you investigating. Not for deep discussion but CETVs have been mental for several years** and those numbers are going to start to come down. If you see anything above 30 times multiple, go and get some (good) advice.Biffer wrote: Thu Oct 13, 2022 10:26 am Some of the overhaul has already been done - now contributory, average salary not final salary, retirement age now in line with state pension instead of 60 - but as with everything pensions related, it takes decades to have an effect. And it's just impossible to take historical benefits away. Civil servants get paid less than they would in industry (substantially so in a lot of cases, we can't recruit mid career engineers for love nor money as we're about £15-20k short of market rates in some disciplines) and one of the reasons that's always pointed to for that is the pension. The only further 'overhaul' is to take that down to industry pension levels but that would then require massive pay rises (or if not, huge leavers from the CS to the extent that government wouldn't function*) which no government is going to take on. The can will continue to be kicked down the road.

So how exactly does anyone fix that?

One of the major problems with all of this is the demographic timebomb - but we're shutting down immigration (or so we're led to believe, how accurate that is is debatable) so that's only going to get worse.

*And when I say wouldn't function I mean all the standard things done that people don't think about - benefits, taxes, justice, passports and drivers licenses, a huge long list that would just collapse.

Edit - in all honesty I've got it in the back of my head that I might just take the transfer value from my CS pension and run if that's an option a year or so before I retire. I'm a single man with no kids, so I can potentially get a better return without the assumption of the widow's pension costed in to the calculation (which it automatically is within the scheme). But the shit might have hit the fan before I get to that stage.

**Because scheme actuaries and trustees are f**kwits and by being so, have considerably worsened the deficit issue.

Yeah, I will. But it's probably ten years or so until I retire and my understanding is it's best to wait until shortly before retirement for cashing out of a defined benefit scheme - and that's probably particularly true with the economy facing a shit show atm.Torquemada 1420 wrote: Thu Oct 13, 2022 11:51 amIn all seriousness, it's worth you investigating. Not for deep discussion but CETVs have been mental for several years** and those numbers are going to start to come down. If you see anything above 30 times multiple, go and get some (good) advice.Biffer wrote: Thu Oct 13, 2022 10:26 am Some of the overhaul has already been done - now contributory, average salary not final salary, retirement age now in line with state pension instead of 60 - but as with everything pensions related, it takes decades to have an effect. And it's just impossible to take historical benefits away. Civil servants get paid less than they would in industry (substantially so in a lot of cases, we can't recruit mid career engineers for love nor money as we're about £15-20k short of market rates in some disciplines) and one of the reasons that's always pointed to for that is the pension. The only further 'overhaul' is to take that down to industry pension levels but that would then require massive pay rises (or if not, huge leavers from the CS to the extent that government wouldn't function*) which no government is going to take on. The can will continue to be kicked down the road.

So how exactly does anyone fix that?

One of the major problems with all of this is the demographic timebomb - but we're shutting down immigration (or so we're led to believe, how accurate that is is debatable) so that's only going to get worse.

*And when I say wouldn't function I mean all the standard things done that people don't think about - benefits, taxes, justice, passports and drivers licenses, a huge long list that would just collapse.

Edit - in all honesty I've got it in the back of my head that I might just take the transfer value from my CS pension and run if that's an option a year or so before I retire. I'm a single man with no kids, so I can potentially get a better return without the assumption of the widow's pension costed in to the calculation (which it automatically is within the scheme). But the shit might have hit the fan before I get to that stage.

**Because scheme actuaries and trustees are f**kwits and by being so, have considerably worsened the deficit issue.

And are there two g’s in Bugger Off?

I wonder if anyone has told Kamikwaze?tc27 wrote: Thu Oct 13, 2022 12:22 pm Looks like the markets have forced the governments hand - U turn on budget expected this afternoon.

Adside from the US is there a free-market economy immune to the 'invisible hand' of debt and currency markets?

It has been years since I was involved in pensions, but one thing I do recall is actuaries ranting about the short termism of trustees and firms.Torquemada 1420 wrote: Thu Oct 13, 2022 11:51 am**Because scheme actuaries and trustees are f**kwits and by being so, have considerably worsened the deficit issue.

Their case was that their models worked over decades. There would be the fat and the lean over those timescales, but they would balance out. But when the economy was strong , when markets were booming and funds were notionally hugely over funded, firms stopped making contributions and profits were boosted. One bank I worked for made no contributions to its DB fund for over a decade. So when the lean came, the funds were screwed.

In the instance I mention, in the good years the actuaries were told to go away and rework their models as their forecast of what would happen in the economy, and the volatility of fund values that would result, were far too pessimistic. On these new more optimistic forecasts, the reduced funding was justified. In the end it turned out the actuaries had actually been a bit optimistic.

Firms and trustees were equally culpable in this. Firms for diverting contributions to boost profits, trustees for letting them Actuaries I knew had to take some of the blame as they were not staunch enough in defending their models.

I have three DB pensions, my wife had one coming, but she cashed out several years back. An awful lot depends on the position of the underlying fund and how desperate they are to get rid of long term liabilities. In her case she was offered a stupid sum so took it. As a rule of thumb, if they are offering, take the money as they are trying to get rid of you so usually give good offers.Biffer wrote: Thu Oct 13, 2022 12:01 pmYeah, I will. But it's probably ten years or so until I retire and my understanding is it's best to wait until shortly before retirement for cashing out of a defined benefit scheme - and that's probably particularly true with the economy facing a shit show atm.

DB is fine gives a certain degree of long term security, but all three of mine are capped at the lesser of inflation or 5%. So if inflation takes off my pensions will erode.

It is worth checking up on periodically.

- tabascoboy

- Posts: 6803

- Joined: Tue Jun 30, 2020 8:22 am

- Location: 曇りの街

The economic policies of the current British government are not, as some on the left would have it, 'neoliberal'. I don't know what they are, but neoliberalism, despite its many short-term and long-term deficiencies, isn't about driving fiscal policies that almost obliterate currency and bond markets. Neoliberalism depends, hugely, on stability at 'opposing ends' - the British government don't seem to believe in, or know how to achieve, stability at any end. It's quite remarkable and what might baffle the far-left is that everysingle dyed-in-the-wool proponent of centrist neoliberalism around the globe was baffled, alarmed and contemptuous of Truss' mini-budget'. They were its biggest and most rational critics. Again, it's not neoliberalism.

The British government's economic policy seems to be driven more by a weird mixture of extreme libertarian (as in genuine Neo-Hayekian ideologue) think tanks and a Brexiteer conception of economics that appeal to entirely bogus ideas like 'national will' or 'national destiny', but which is really about not just protecting but bolstering and expanding the interests of Tory cronies in the post-Brexit environment. Johnson set this precedent, yet Truss has come into power and tried to just go for broke with it. Post-truth economics, where all the negative economic realities of Brexit can't be reasonably discussed or refuted whether intellectually or politically, but rather dismissed with Johnsonian bluster and absurdist narratives of Britannia unchained, while focus is put solely on cronies and those who provide the Tories with their most lucrative base. It was the most brutal and blatant attempt to forge economic injustice since the worst parts of Thatcherism (again, of course Thatcherism was nascent neoliberalism, but nothing about neoliberalism necessitates something as fundamentally unfair as the poll tax).

The theories that Truss knows the Tories will lose the next election, and is thus just pushing ahead with an accelerated and compressed version of the fiscal policy that Brexit was supposed to engender, seem interesting, but I genuinely do think that it's more a case that the Tory Party is transforming, nay disintegrating, and these wild, seemingly insane swings are part of that transformation/disintegration - the transformation from centre-right to some kind of hybrid illiberal right-wing populist party. There is a point that Truss is already a kind of hostage to the parliamentary party. Who knows what will emerge and how much more damage will be done.

- Hal Jordan

- Posts: 4594

- Joined: Tue Jun 30, 2020 12:48 pm

- Location: Sector 2814

I, for one, am glad that our Parliamentary system has delivered a lack of unstable governments, factionalism, frequent changes of leader and influence from extreme political parties that are the hallmark of the coalitions created under proportional representation, so favoured by Johnny Foreigner.

They are all jealous of Dizzy lizzy.Hal Jordan wrote: Thu Oct 13, 2022 1:47 pm I, for one, am glad that our Parliamentary system has delivered a lack of unstable governments, factionalism, frequent changes of leader and influence from extreme political parties that are the hallmark of the coalitions created under proportional representation, so favoured by Johnny Foreigner.

- The sun god

- Posts: 176

- Joined: Wed Jul 01, 2020 6:40 am

- Location: It's nice in Nice.

Just watched an interview with Kwarteng on Bloomberg TV...... I am sure he is an educated man but he is a totally clueless politician

who could still yet cause some really serious difficulties for the UK capital markets unless he stops speaking out of both sides of his mouth.

How do these people get promoted to this level ?

who could still yet cause some really serious difficulties for the UK capital markets unless he stops speaking out of both sides of his mouth.

How do these people get promoted to this level ?

- fishfoodie

- Posts: 8729

- Joined: Mon Jun 29, 2020 8:25 pm

The Old Fashioned way .... fucking the Boss !The sun god wrote: Thu Oct 13, 2022 2:24 pm Just watched an interview with Kwarteng on Bloomberg TV...... I am sure he is an educated man but he is a totally clueless politician

who could still yet cause some really serious difficulties for the UK capital markets unless he stops speaking out of both sides of his mouth.

How do these people get promoted to this level ?

That's the rumourfishfoodie wrote: Thu Oct 13, 2022 2:30 pmThe Old Fashioned way .... fucking the Boss !The sun god wrote: Thu Oct 13, 2022 2:24 pm Just watched an interview with Kwarteng on Bloomberg TV...... I am sure he is an educated man but he is a totally clueless politician

who could still yet cause some really serious difficulties for the UK capital markets unless he stops speaking out of both sides of his mouth.

How do these people get promoted to this level ?

And are there two g’s in Bugger Off?

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

There are so many moving parts in the decision making process which is why there are so, so few professionals capable of correctly analysing the merits (including, it seems, too many scheme actuaries). Transfers has been a sweet spot for some years now and it will close: and it's down to an actuarial mismatch between the gilt assumptions used in transfer (CETV) calcs and scheme liabilities (remainers). I've written on this subject a few times and warned that scheme trustees face the prospect of a barrage of negligence claims if their schemes fail because, in effect, they've been subsidising the inflated transfers of scheme leavers from the pot of the remaining members: the very people to whom they owe all their statutory duties.Biffer wrote: Thu Oct 13, 2022 12:01 pm Yeah, I will. But it's probably ten years or so until I retire and my understanding is it's best to wait until shortly before retirement for cashing out of a defined benefit scheme - and that's probably particularly true with the economy facing a shit show atm.

Interesting: that perspective on timing is a regulatory driven thing which has resulted in informing PI insurers' behaviour. Incorrectly so. It's only really true (ish... still lots of other factors) if you are talking about an active member bailing i.e. still is accruing entitlement. A very different thing to someone with preserved benefits: has a new job and another pension. So yeah, if you are still working for the CS, don't bother about it too much: not least because you will struggle to find anyone who will conduct an advised transfer for you EVEN IF the numbers stacked up (note: I think there are zero takers amongst pension providers who till take an FS transfer from a client who had not sought advice).

In many ways, it's the reverse. If you are going from a g'td environment to a speculative one (DC), then you want a long time frame before having to rely upon outcome (pension income) because that reduces the risk of adverse investment movements killing you (esp sequential risk). You did not want to do a DB transfer in 2008

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

No. It's what happens when you deregulate and you move away from some form of defined currency exchange system.tc27 wrote: Thu Oct 13, 2022 12:22 pm Looks like the markets have forced the governments hand - U turn on budget expected this afternoon.

Adside from the US is there a free-market economy immune to the 'invisible hand' of debt and currency markets?

I thought it was more than a rumour.............and not just himBiffer wrote: Thu Oct 13, 2022 2:33 pmThat's the rumourfishfoodie wrote: Thu Oct 13, 2022 2:30 pmThe Old Fashioned way .... fucking the Boss !The sun god wrote: Thu Oct 13, 2022 2:24 pm Just watched an interview with Kwarteng on Bloomberg TV...... I am sure he is an educated man but he is a totally clueless politician

who could still yet cause some really serious difficulties for the UK capital markets unless he stops speaking out of both sides of his mouth.

How do these people get promoted to this level ?

This is going to work......not

She sought to defuse tensions in the party by inviting them to chat about issues and pet projects in their area over tea and Pret sandwiches.

The PM and a seemingly random assortment of backbenchers from different intakes and regions chatted predominantly about infrastructure, sources told the Guardian.

One Truss supporter who attended said she was “very buoyant”, but a sceptic said it was just incredibly awkward.

“It’s so fucking transparent,” they sighed. “We’re only there because she’s in trouble.”

- The sun god

- Posts: 176

- Joined: Wed Jul 01, 2020 6:40 am

- Location: It's nice in Nice.

Which, I have from a very good UK journo source, he does with considerable aplomb !!!fishfoodie wrote: Thu Oct 13, 2022 2:30 pmThe Old Fashioned way .... fucking the Boss !The sun god wrote: Thu Oct 13, 2022 2:24 pm Just watched an interview with Kwarteng on Bloomberg TV...... I am sure he is an educated man but he is a totally clueless politician

who could still yet cause some really serious difficulties for the UK capital markets unless he stops speaking out of both sides of his mouth.

How do these people get promoted to this level ?

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

That is going wayyyyyyy back? I.E. when the likes of Vauxhall started to take contribution holidays (when that was still legal) and Maxwell stole the funds from the Mirror Group pension.weegie01 wrote: Thu Oct 13, 2022 12:34 pmIt has been years since I was involved in pensions, but one thing I do recall is actuaries ranting about the short termism of trustees and firms.Torquemada 1420 wrote: Thu Oct 13, 2022 11:51 am**Because scheme actuaries and trustees are f**kwits and by being so, have considerably worsened the deficit issue.

Their case was that their models worked over decades. There would be the fat and the lean over those timescales, but they would balance out. But when the economy was strong , when markets were booming and funds were notionally hugely over funded, firms stopped making contributions and profits were boosted. One bank I worked for made no contributions to its DB fund for over a decade. So when the lean came, the funds were screwed.

In the instance I mention, in the good years the actuaries were told to go away and rework their models as their forecast of what would happen in the economy, and the volatility of fund values that would result, were far too pessimistic. On these new more optimistic forecasts, the reduced funding was justified. In the end it turned out the actuaries had actually been a bit optimistic.

Firms and trustees were equally culpable in this. Firms for diverting contributions to boost profits, trustees for letting them Actuaries I knew had to take some of the blame as they were not staunch enough in defending their models.

All of what you say is true. The death was one by a thousand cuts

- increasing life expectancy

- Barber v GRE

- falling investment returns

- falling interest and gilt rates

- the end to contracting out

- the removal of the dividend tax credit

- bad investments

- failure to properly hedge on overseas investments

- getting ripped off by active fund managers

- Thai bride syndrome

- equality for Civil Partnerships

- changes in methodology for conducting scheme valuations

etc

The actuarial failing I am referring to is easier to explain with a made up set of nos. All schemes use a valuation methodology which is meant to comply with the 17/102 framework. We can ignore that the rules remain lax enough to the extent that with pensions, you could almost make up any picture you like by tweaking the tolerances you are permitted to operate with key parameters. And we will assume the methodology is unchanged.

What trustees decided to do to reduce scheme liabilities was to offer transfers (again, ignore that it's a statutory right after 2 years membership because you can circumvent that by simply offering a sh*t TV). It does not take Einstein to work out that in order for that to work, the transfer needs to represent LESS that the ongoing liability you are trying to dispense with**. Granted, this is a tricky game: you want members to leave but not by giving fair value. Hence we saw all kinds of dodgy inducements offered by schemes and employers, most of which are now banned.

**Instead, schemes have done the opposite. How?

It's all in the nuances of gilt nos(here on, I will make up the nos because it's easier to see). Keep in mind that DB and DC are totally different animals and trying to map one to another is simply hard and inexact anyway.

- What the schemes have been doing is pricing their long term liabilities using long term gilt nos. Let's say that coupon was 5%. And schemes are eternal and so, it kinda makes sense to use the long term gilt pricing if that is your primary building block to meeting liabilities.

- BUT............. wait for it........... post 2008 and QE, we ended up with an anomaly where short term gilt coupons were markedly lower than the long dated ones already held by schemes. Let's say 2.5%. Mr Actuary does a CETV for Lloyds Bank Manager who has a preserved pension of £20kpa and arrives at £20k x (100%/2.5%) = £800k transfer value (because a transfer is a short term liability....). 40 x multiple. Do the maths: even if you invest that in cash at 0% return, in effect you have to live 40 years before your money runs out in your transfer pot. I've ignored inflation. High 30x CETVs has been very much the norm.

- Meantime scheme liabilities are being accounted for at 5% and so anyone in the scheme is having his ongoing £20k pension being valued as a liability at £20k x (100%/5%) = £400k.

The actual margins are not as wide as that and I've simplified or skipped other elements but the salient point remains: in order to try and protect the survival of their schemes, trustees/actuaries have been sanctioning robbing members to subsidise leavers.

This has resulted in an avalanche of transfers. It matters not that f**k all anybody understood why the transfer values were so high: even the thickest financial adviser or the dimmest client could work out that a transfer in excess of 30x a preserved pension looked very tempting. Even more so if you realised it was going to make the likelihood of the scheme go pop.

Last edited by Torquemada 1420 on Thu Oct 13, 2022 3:12 pm, edited 2 times in total.

- Paddington Bear

- Posts: 6653

- Joined: Tue Jun 30, 2020 3:29 pm

- Location: Hertfordshire

It may be that I just haven't found it, but it strikes me you could write a pretty definitive history of Britain over the last century or so framed around beating retreats in the face of the currency markets.tc27 wrote: Thu Oct 13, 2022 12:22 pm Looks like the markets have forced the governments hand - U turn on budget expected this afternoon.

Adside from the US is there a free-market economy immune to the 'invisible hand' of debt and currency markets?

Old men forget: yet all shall be forgot, But he'll remember with advantages, What feats he did that day

- Torquemada 1420

- Posts: 11945

- Joined: Thu Jul 02, 2020 8:22 am

- Location: Hut 8

Hardly. Such things did not happen under the Gold Standard or even Bretton Woods.Paddington Bear wrote: Thu Oct 13, 2022 3:09 pmIt may be that I just haven't found it, but it strikes me you could write a pretty definitive history of Britain over the last century or so framed around beating retreats in the face of the currency markets.tc27 wrote: Thu Oct 13, 2022 12:22 pm Looks like the markets have forced the governments hand - U turn on budget expected this afternoon.

Adside from the US is there a free-market economy immune to the 'invisible hand' of debt and currency markets?

- Paddington Bear

- Posts: 6653

- Joined: Tue Jun 30, 2020 3:29 pm

- Location: Hertfordshire

Pretty dubious - a significant amount of the slump and British policy in the 1930s was massively influenced by the Gold Standard, and Bretton Woods involved a huge amount of attempted face saving.Torquemada 1420 wrote: Thu Oct 13, 2022 3:13 pmHardly. Such things did not happen under the Gold Standard or even Bretton Woods.Paddington Bear wrote: Thu Oct 13, 2022 3:09 pmIt may be that I just haven't found it, but it strikes me you could write a pretty definitive history of Britain over the last century or so framed around beating retreats in the face of the currency markets.tc27 wrote: Thu Oct 13, 2022 12:22 pm Looks like the markets have forced the governments hand - U turn on budget expected this afternoon.

Adside from the US is there a free-market economy immune to the 'invisible hand' of debt and currency markets?

Old men forget: yet all shall be forgot, But he'll remember with advantages, What feats he did that day

- fishfoodie

- Posts: 8729

- Joined: Mon Jun 29, 2020 8:25 pm

Every Cloud has a silver lining.C69 wrote: Thu Oct 13, 2022 5:06 pm Well there is no fucking chance of Truss and Quasi savimg face.

They are a joke, fringe crackpots who are an utter laughing stock and a danger to the Union.

It's a lot harder for anyone to take digs at the viability of an Independent Scottish Economy, with the shambles going on south of the border.

Much like the political institutions; if the local assemblies just project stability, & some degree of competence, then its one less argument for the Unionists.

Lol that was exactly the point I was making.fishfoodie wrote: Thu Oct 13, 2022 5:17 pmEvery Cloud has a silver lining.C69 wrote: Thu Oct 13, 2022 5:06 pm Well there is no fucking chance of Truss and Quasi savimg face.

They are a joke, fringe crackpots who are an utter laughing stock and a danger to the Union.

It's a lot harder for anyone to take digs at the viability of an Independent Scottish Economy, with the shambles going on south of the border.

Much like the political institutions; if the local assemblies just project stability, & some degree of competence, then its one less argument for the Unionists.

First Boris and now this

- Insane_Homer

- Posts: 5506

- Joined: Tue Jun 30, 2020 3:14 pm

- Location: Leafy Surrey

Wups.

“Facts are meaningless. You could use facts to prove anything that's even remotely true.”

I think the opposite is true actually:fishfoodie wrote: Thu Oct 13, 2022 5:17 pmEvery Cloud has a silver lining.C69 wrote: Thu Oct 13, 2022 5:06 pm Well there is no fucking chance of Truss and Quasi savimg face.

They are a joke, fringe crackpots who are an utter laughing stock and a danger to the Union.

It's a lot harder for anyone to take digs at the viability of an Independent Scottish Economy, with the shambles going on south of the border.

Much like the political institutions; if the local assemblies just project stability, & some degree of competence, then its one less argument for the Unionists.

1) Boris/Tories has been used as one of SNP selling points, but Truss has ensured this will end in two years min. The worse she is less threat they are as it lengthens the time they will be out of power.

2) Recent events have shown how vulnerable what we take for granted is, and there will be no BOE to bail out an independent Scotland..

3) SNP wanted to track the pound last time, so means all the big financial decisions made in Westminster will affect the Scots who will have no say whatsoever. Again recent events will have brought this into sharper focus.

4) Starmer doesn't look likely to reverse Brexit any time soon, and Brexit was a bit of killer for Indy since the security fallback of being in the EU is far more difficult achieve. While SNP tried to use anger at Brexit to their advantage, it really doesn't work if you take the emotion out of it.

1) I think more people are realising that the UK is fundamentally Tory, when Scotland isn’t, and five or ten years of Labour won’t change that. They know the Tories will be back. Since we last voted Tory in Scotland, 40 years out of 63 have been Tory governments that we didn’t vote for.Jockaline wrote: Thu Oct 13, 2022 7:13 pmI think the opposite is true actually:fishfoodie wrote: Thu Oct 13, 2022 5:17 pmEvery Cloud has a silver lining.C69 wrote: Thu Oct 13, 2022 5:06 pm Well there is no fucking chance of Truss and Quasi savimg face.

They are a joke, fringe crackpots who are an utter laughing stock and a danger to the Union.

It's a lot harder for anyone to take digs at the viability of an Independent Scottish Economy, with the shambles going on south of the border.

Much like the political institutions; if the local assemblies just project stability, & some degree of competence, then its one less argument for the Unionists.

1) Boris/Tories has been used as one of SNP selling points, but Truss has ensured this will end in two years min. The worse she is less threat they are as it lengthens the time they will be out of power.

2) Recent events have shown how vulnerable what we take for granted is, and there will be no BOE to bail out an independent Scotland..

3) SNP wanted to track the pound last time, so means all the big financial decisions made in Westminster will affect the Scots who will have no say whatsoever. Again recent events will have brought this into sharper focus.

4) Starmer doesn't look likely to reverse Brexit any time soon, and Brexit was a bit of killer for Indy since the security fallback of being in the EU is far more difficult achieve. While SNP tried to use anger at Brexit to their advantage, it really doesn't work if you take the emotion out of it.

2) valid point, but it doesn’t seem any of us are really being protected that much right now.

3) that was a policy to reassure people about stability. I know a lot of Indy supporters who would happily tie to the euro, and a different approach is more likely given the recent shitshow

4) Scotland would rapidly get access to the EEA and / or EFTA and look to rejoin the EU.

Overall question is there’s pain coming, do you want it as part of a petty minded little englander Uak or as part of the broad shoulders of Europe.

And are there two g’s in Bugger Off?